You can’t swipe your way to scalable procurement

Why high-growth companies are abandoning card-based spend management

For many companies exploring finance automation, card-based spend management solutions are a popular first step. With sleek virtual and physical cards, real-time expensive visibility, and easy integrations, these platforms offer an appealing entry point for small teams seeking control and clarity around business expenses.

But as companies begin to scale, many teams encounter new challenges that fall outside the boundaries of finance automation alone. The friction often isn’t in visibility or employee reimbursements — it’s upstream, in the fragmented, manual workflows of purchasing.

For fast-growing businesses managing orders across 10, 50, or even hundreds of locations, the core problem becomes operational: ensuring every team member knows where to buy from, what to buy, and how to stay on budget without slowing down the business. This is where procurement automation begins to play a more strategic role.

Fast-growth companies are moving beyond finance automation

A national operator in the entertainment and recreational facilities space recently faced this inflection point. With dozens of locations and more opening rapidly, its procurement process had become a bottleneck. Though they had implemented a card-based spend management solution and were satisfied with spend visibility and expense control, its broader purchasing process remained manual and disjointed, managed largely through spreadsheets, shared drives, and email threads.

They discovered that by implementing Order.co, they weren’t simply procurement, streamlining they were unlocking more operational value than their existing card-based solution could provide.

Procurement at scale requires a new approach

Most businesses using finance automation tools follow a predictable path: an employee creates a purchase order, routes it for approval, and then manually places the order with the vendor. In many cases, they bypass the process entirely and simply swipe a card, void of approval before the purchase is complete. It’s a standard approach but riddled with friction, compliance gaps, and blind spots.

The challenges are threefold. First, compliance is optional; employees can easily bypass systems and spend off policy. Second, it’s inefficient; managers must enter PO requests, chase approvals, and then communicate with vendors or navigate multiple sites to place the orders. Finally, there’s no way to know if you’re buying from the right vendor unless someone is constantly checking spreadsheets, comparing options across price, reliability, and availability.

Where card solutions leave off, Order.co takes over

These breakdowns in compliance, efficiency, and vendor choice aren’t addressed by card providers. Order.co eliminates these friction points by embedding control, automation, and AI directly into the purchasing process.

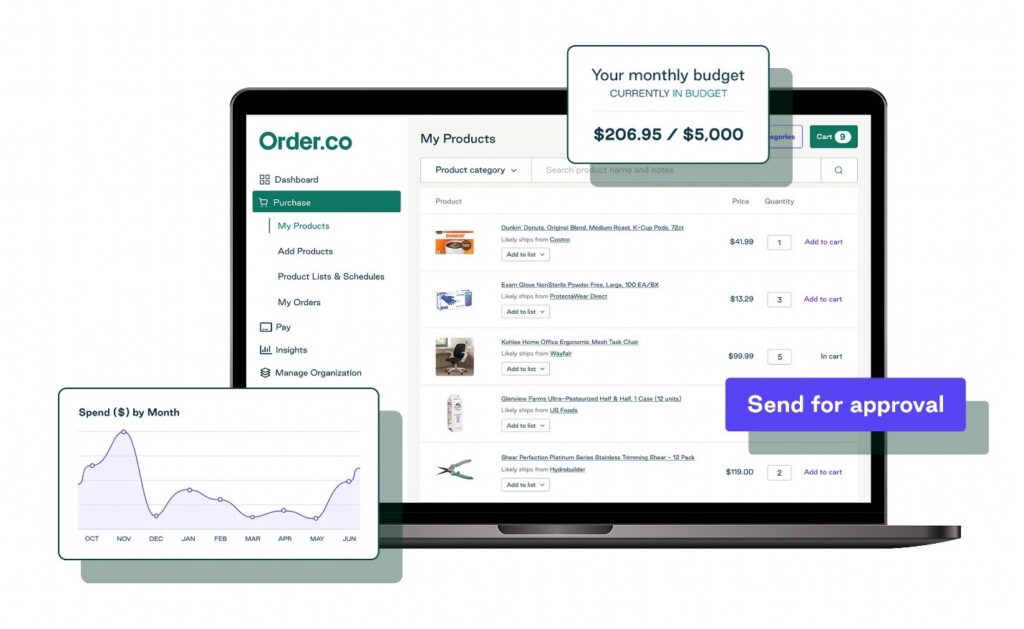

Once a business shops in its curated marketplace in the Order.co platform and submits a cart, the order automatically routes through a customized approval workflow. If approved, Order.co AI takes over, generating purchase orders, completing checkouts on vendor websites, and ensuring nothing slips through the cracks.

The result is a system where compliance becomes the default, not a manual checkpoint. Every purchase, from any vendor, flows through a unified process that guarantees visibility, control, and accountability with no workarounds.

That centralized control becomes even more powerful at scale. As fast-growing companies expand across locations and teams, they need to maintain consistency in what’s purchased and how. With Order.co, approvers can accept, reject, or edit requests at the SKU level—giving businesses control over quantity, quality, and brand standards before the spend ever happens.

Beyond approvals and process control, Order.co AI helps businesses optimize vendor selection at scale. Rather than relying on static lists or manual comparisons, the platform evaluates each purchase in real time, factoring in price, availability, delivery timelines, vendor and reliability more. In addition to budget reinforcement, Order.co AI ensures employees consistently buy from the best-fit vendor for every item, every time. It’s how businesses leverage Order.co to transform procurement from a reactive function into a strategic advantage.

Built-in finance automation

Once companies centralize purchasing, the benefits compound. Order.co doesn’t just automate procurement, it solves finance automation, too.

Every item in a business’s system is pre-coded with the correct GL code, which then syncs with a business’s accounting system, ensuring finance teams aren’t left chasing down data, correcting errors, or manually matching line items. Books stay clean and accurate, and month end closes faster.

In addition, centralizing purchasing through a single platform unlocks significant payment flexibility. Order.co pays vendors upfront on behalf of the customer, preserving supplier relationships and ensuring orders are fulfilled without delay. On the customer side, purchases are consolidated into a single invoice, eliminating the burden of managing dozens or hundreds of vendor payments.

And, with Net 30 terms built in, businesses gain up to 37 days of float without the need to negotiate payment terms or apply for additional credit. It’s a level of financial control and cash flow flexibility that goes far beyond what card-based spend management solutions can offer. In short: businesses pay on their terms, without disrupting how they buy.

Built for Scale, Not Just Spend

Card-based tools have helped startups bring visibility to corporate spend, but spend management is only part of the equation. For businesses entering periods expansion, the of rapid greatest opportunity for efficiency and competitive advantage in lies procurement. Companies that can replicate purchasing processes across standardize what’s locations, bought, and maintain control without slowing down frontline teams are better positioned to scale.

Order.co helps unlock that capability. Rather than focusing solely on how finance teams track spend, they address how purchasing happens across the organization. By embedding control, reducing friction, and creating a more intelligent buying experience, procurement becomes not just a cost center, but a strategic enabler of growth.

It’s a shift more finance and operations leaders are starting to embrace: moving beyond spend visibility and toward intelligent procurement that supports scale from day one.

Company Name : Order.co

Website: https://www.order.co/

Management Team

Zachary Garippa | Co-Founder and CEO